|

|

|

Name

Cash Bids

Market Data

News

Ag Commentary

Weather

Resources

|

Apple Stock Price Prediction: Should You Buy the Post-Earnings Dip in AAPL?/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

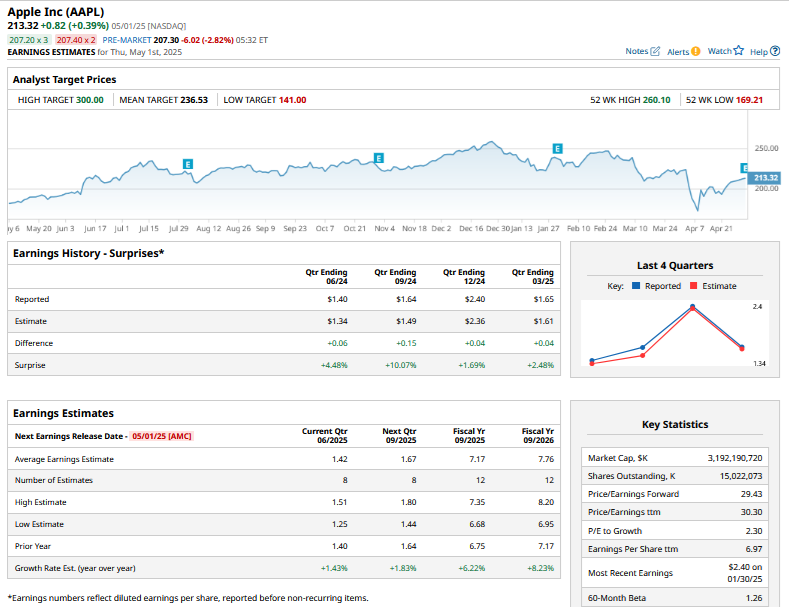

Apple (AAPL) released its fiscal second-quarter 2025 earnings yesterday, May 1, after the markets closed. The stock is in the red today like its “Magnificent 7” peer Amazon (AMZN), which spooked markets with its guidance for the current quarter. In this article, we’ll examine Apple’s forecast and gauge whether it makes sense to buy the post-earnings dip. Apple Posted Better-Than-Expected EarningsTo begin with, Apple beat on both the top line and the bottom line as the performance of its hardware business, including iPhones, was better than expected. The revenues of its hugely profitable Services business were a tad short of estimates, but its overall gross margins came in line with estimates of 47.1%.  Apple’s guidance was also quite upbeat, considering the macroeconomic slowdown. The Cupertino-based company guided for an annual revenue increase of “low to mid-single digits” in the current quarter. Key Takeaways from Apple Q2 EarningsAlong with the headline numbers, markets were awaiting clarity on how tariffs are impacting Apple. Here are some of the key takeaways on that front:

Overall, I would say that Apple not only posted a good set of numbers in the quarter but also provided quite an upbeat outlook, particularly on the impact of the tariffs. However, the stock is in the red today primarily for two reasons. Firstly, there is still a lot of uncertainty over the tariffs and their impact beyond the current quarter. Secondly, markets are worried about the outlook of Apple’s Services business, which happens to be its most profitable segment. Apple’s Service Business Faces ChallengesDuring the fiscal second quarter, Apple’s Services business posted record revenues and accounted for nearly 28% of its consolidated sales. The contribution of Services to Apple’s total revenues has been growing steadily, which has helped propel its margins higher, as the gross margins of the Services business are significantly higher and were specifically over twice that of the Product business in Q2. The higher contribution from the Services business is one reason Apple’s valuation multiples expanded and its trading multiples moved in the ballpark of what we usually associate with a software and tech company rather than a hardware company. Despite having fallen from its all-time highs, Apple still trades at a forward price-earnings (P/E) multiple of 29.4x, which is significantly higher than what the stock has historically traded at.  Meanwhile, while Apple’s Product business has been in the spotlight amid the tariff chaos, the company’s Services business is also facing some headwinds. It was forced to allow third-party app stores in Europe under the region’s Digital Markets Act, which could eat into its lucrative revenues from App Store fees. Now, in its ongoing dispute with Fortnite publisher Epic Games, the judge has ruled that Apple needs to loosen its stringent App Store rules and stop collecting fees on purchases made outside apps. In her 80-page ruling, District Judge Yvonne Gonzalez Rogers lashed out at Apple and said that some company executives “outright lied under oath.” Apple Stock Price PredictionApple remains one of the most iconic brands, and the company enjoys a large moat. Management has also proven its mettle over time, most recently by displaying the supply chain elasticity that it built well in advance of eventual U.S.-China trade tension. No wonder Apple is still the largest holding for Warren Buffett’s Berkshire Hathaway (BRK.B) as the iPhone maker practically brings almost everything to the table that the “Oracle of Omaha” looks for in investments. However, Apple is currently facing some serious challenges. These include the legal issues around its App Store policies, uncertainty over tariffs, the intensifying challenge for Chinese smartphone makers, and its loss of market share in China. While I continue to hold some Apple shares as a core part of my portfolio, I won’t buy the dip now and will be on the sidelines despite impressive quarterly performance from the Tim Cook-led company. On the date of publication, Mohit Oberoi had a position in: AAPL , AMZN , MSFT , BRK.B . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|